- Home

- About

- News

- Tax Reform

- Ethics Reform

- Budget Reform

- Reformer’s Roundtable

- Contact Us

YOU MUST APPEAL YOUR PROPERTY TAX ASSESSMENTS BECAUSE THEY ARE UNFAIR -- AND ILLEGAL

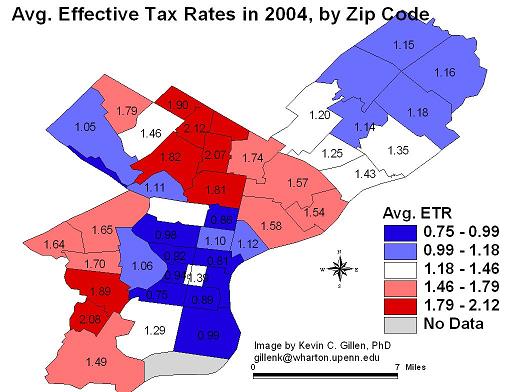

Property taxes in Philadelphia are unfair and, today, some homeowners pay too much while others do not pay their fair share. The current round of reassessments does not fix the system and is, therefore, nothing more than a back-door tax increase that is illegal, improper, and unjust. All property owners should appeal their assessments. No matter how undervalued your house is for tax purposes, SOMEONE is getting a better deal than you and that is not right. (As the graphic to the left illustrates, different neighborhoods effectively have different tax rates...you can click on the graphic to see a larger view.) To review appeal procedures, visit the BRT's website. Click "read more" below to learn how to craft a winning appeal...

Property taxes in Philadelphia are unfair and, today, some homeowners pay too much while others do not pay their fair share. The current round of reassessments does not fix the system and is, therefore, nothing more than a back-door tax increase that is illegal, improper, and unjust. All property owners should appeal their assessments. No matter how undervalued your house is for tax purposes, SOMEONE is getting a better deal than you and that is not right. (As the graphic to the left illustrates, different neighborhoods effectively have different tax rates...you can click on the graphic to see a larger view.) To review appeal procedures, visit the BRT's website. Click "read more" below to learn how to craft a winning appeal...

1) Find the form "REAL ESTATE MARKET VALUE APPEAL FOR TAX YEAR 2008" which should have been mailed to you as part of the package of information that came with your reassessment.

2) Enter your name, telephone, address, and city, state & zip code.

3) Under "SELECT ONE OPTION" check the first box ("I will attend the public hearing. I request an oral hearing.")

4) Fill in the blank in the sentence "I believe that the market value of this property is $ _________." with the value you believe your property would be worth if you were to sell it today -- be honest...the key to the appeal is that other properties (we will provide you with actual examples) are getting a better deal than you.

5) Check the box "Nonuniformity" to complete the sentence "I base my opinion on the following reason(s)" because you will be claiming that your property is not being treated the same as other properties.

6) Attach the following language to your appeal to demonstrate that you understand that all properties are to be treated uniformly, but that in Philadelphia the entire assessment system is fundamentally flawed...(feel free to cut and paste and print it out to attach to your appeal)

The Philadelphia Tax Reform Commission established that: "Philadelphia’s property assessments do not meet industry standards for accuracy; all across the city, assessed values diverge widely from market values. Philadelphia’s property assessments do not meet industry standards for equity; properties in poorer neighborhoods are, on average, assessed at a higher percentage of market value than properties in more affluent neighborhoods. The inaccuracy and regressive nature of Philadelphia’s assessments violate standards of vertical and horizontal equity."

In his recent ruling in Clifton vs. Allegheny County, Judge Stanton Wettick found that "Using income tax terminology, one out of every four Philadelphia property owners was in a tax bracket of at least 3.35% and one out of every four property owners was in a tax bracket that did not exceed 1.42%"

Understanding that current assessments are flawed, the Board of Revision of Taxes (BRT) has invested significant public funds in an effort to correct its valuation system. However, it is clear that the proposed reassessment does not provide for uniform taxation of my property.

The BRT explains the definition of “Market Value” on its web site — "A current economic definition agreed upon by agencies that regulate federal financial institutions in the United States is: The most probable price (in terms of money) which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus."

If, by law, all properties are to be assessed uniformly, then all properties should share the same basic relationship between their current potential resale value and their “Market Value” for tax purposes. But that is not the case in Philadelphia today.

While my property would probably sell for [INSERT YOUR CURRENT HOME VALUE], my new assessment would increase my home’s Market Value to [INSERT YOUR NEW MARKET VALUE AS PER THE BRT], which would base my taxes on approximately [INSERT THE CORRECT PERCENTAGE] percent of its current value. However, other homes are valued for tax purposes at a significantly smaller percentage of current value including:• 1935 Poplar Street, which sold recently for $315,000, but would have a BRT Market Value of $25,600 or only 8 percent of its recent sale price;

• 2339 St. Albans Street, which sold recently for $480,000, but would have a BRT Market Value of $49,600 or only 10 percent of its recent sale price; or

• 523 S. 41st Street, which sold recently for $525,000, but would have a BRT Market Value of $59,800 or only 11 percent of its recent sale price.The Pennsylvania Constitution demands that “all taxes shall be uniform, upon the same class of subjects, within the territorial limits of the authority levying the tax.” The city is in comprehensive violation of uniformity and the most-recent assessments do not correct the problems. The assessment lacks uniformity with other properties within the taxing jurisdiction and is therefore illegal, improper and unjust. My increase should be rescinded and the city should complete a comprehensive and fair reassessment of properties so that assessments meet industry standards for accuracy and equity and the Constitutional mandate of uniformity.

Philadelphia Forward developed this language for you attach to your appeal and we will be happy to stand with you before the Board of Revision of Taxes to help you make your case.

*

Philadelphia Forward created an interactive web resource on its website to illustrate that similar homes in different parts of the city are taxed DIFFERENTLY -- and that some are paying too much while others aren't paying their fair share. You can access all the information here -- http://www.philadelphiaforward.org/reassessmentFor more information about the Tax Reform Commission's conclusions about the unfairness of the current system and recommendations to fix what is wrong to make Real Estate Taxation fair and understandable, visit -- http://www.philadelphiaforward.org/citywide_reassessment